Article

4 Deepfakes Defense Strategy Factors to Prioritize

Pindrop

August 11, 2023 (UPDATED ON October 30, 2025)

6 minutes read time

In the rapidly evolving landscape of cyber threats, the escalating prominence of deepfake attacks demands a comprehensive technical response. As organizations grapple with the complexities of this digital deception, a proactive approach becomes paramount.

1200% That’s the proportion of increase in deepfakes among all fraud types in the US in 1Q 20231. We’re seeing this play out in highly publicized examples such as scammers using AI to target individuals or this fraudster stealing over $600k by impersonating as the target’s friend. Senator Brown’s email to the top 6 US banks put Deepfake on the agenda of Chief Risk Officers and the Boards of all financial institutions. Our research indicates that while synthetic content is already present in call centers, it is not yet rampant.

Deepfake is a new topic for most risk, compliance, security teams and for call center operations and technology teams. It got added to their agenda in the early days of 2023. These teams still have more questions than answers, on the technology behind deepfakes, its real risk and the right approach to addressing it. To help our customers navigate the internal discussions on deepfake, Pindrop recently published an ebook on “What Executives Need to Know + Do About Deepfakes”. As a follow up, we’re sharing learnings from a survey of 100+ executives and other meetings with executives responsible for risk, cybersecurity and call center technology in 40 top financial institutions, retailers and healthcare companies in the US.

1. Help your leadership team understand deepfake technology and its risks

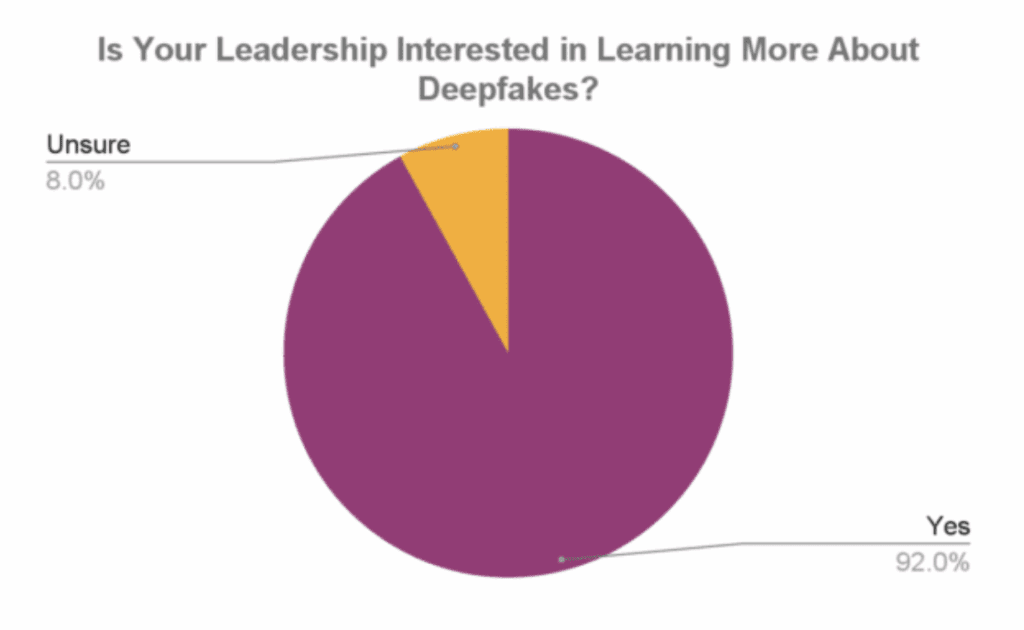

Deepfake detection is starting to be a growing concern. 92% of respondents expressed interest in learning more about deepfakes. Banks, credit unions and insurance firms are most concerned about deepfakes. Interest in retailers and other industries is not as high as-yet. Deepfake detection has become a buying criteria for Pindrop customers who are evaluating new authentication platforms or planning to upgrade their existing authentication solutions. Customers using old, legacy solutions, especially on-premise solutions are exploring adding deepfake to their solutions or migrating to cloud based solutions like Pindrop that are designed for adding deepfake detection.

Source: Pindrop Client Forum Exchange, June 2023 survey of 100 executives across 40 US financial institutions, health care providers and retailers

The interest in deepfakes is often driven from the Chief Risk Officer or the CISO. Call center technology teams are often being asked by risk teams to prepare briefings and do initial assessments of readiness of their authentication and fraud systems. While deepfake protection was not part of the 2023 operating plan, the interest from leadership is forcing the call center product teams to respond quickly.

2. Aim to fortify defenses now, when the risk is still emerging

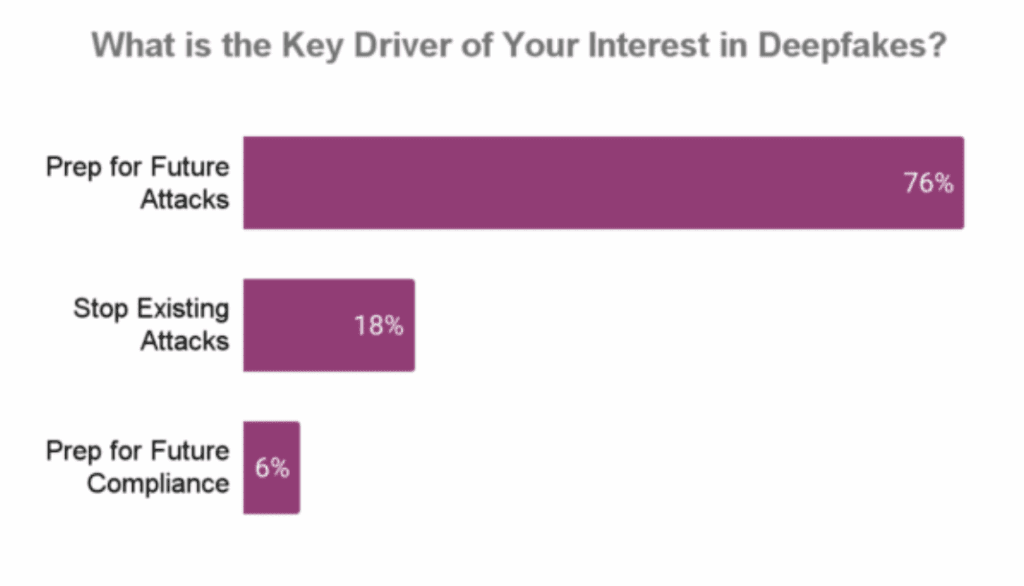

Generative AI has unsealed a Pandora’s Box of impending deepfake threats. Presently, enterprise contact center authentication systems lack optimization for deepfake protection, specifically in identifying real human voices from synthetic or recorded ones. Pindrop incorporated deepfake detection into its Voice API solution in 2022, initially focusing on digital channels. However, the low historical prevalence of deepfakes in call center interactions meant that companies didn’t prioritize them. This scenario shifted dramatically with the advent of generative AI, voice cloning advancements, and increasingly sophisticated Text-to-Speech (TTS) systems. Consequently, companies are now acutely aware of the heightened deepfake risk, compelling them to enact strategies for risk mitigation.

Source: Pindrop Client Forum Exchange, June 2023 survey of 100 executives across 40 US financial institutions, health care providers and retailers

The rapid evolution of generative artificial intelligence technology, especially Text-to-Speech (TTS) systems and the increased frequency of reporting in the media on deepfakes has changed that. Preparedness for the future is top of mind for customers as they plan for deepfake defense. Customers realize that the best time to address a vulnerability is before being attacked.

3. Assess deepfake risks holistically

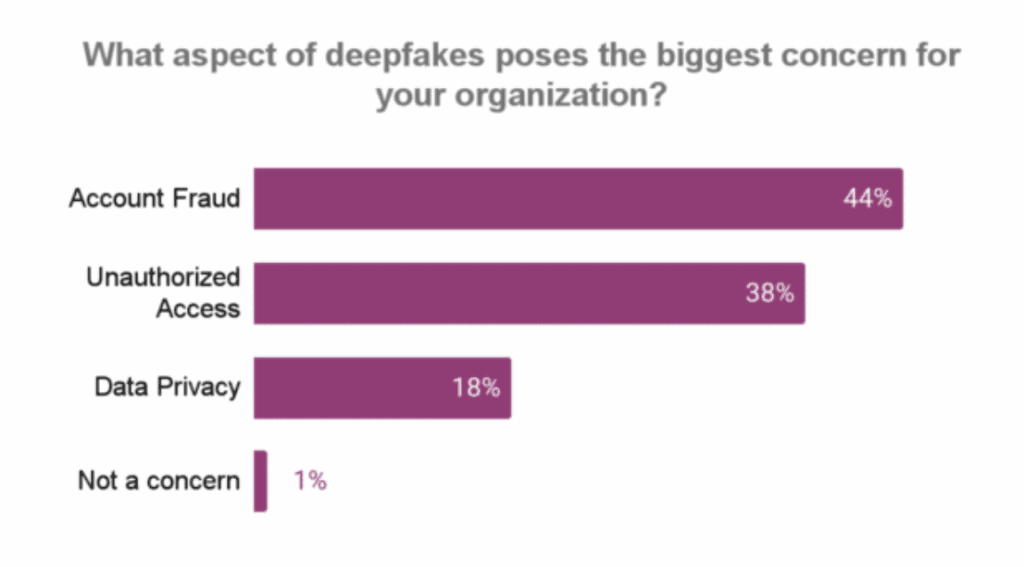

Deepfakes need to be fought on multiple fronts. Account fraud and unauthorized access were the top 2 risks in customers’ minds.

Source: Pindrop Client Forum Exchange, June 2023 survey of 100 executives across 40 US financial institutions, health care providers and retailers

These risks extend beyond the confines of the contact center, permeating all voice-based interactions where trust is fundamental—particularly in the realm of high-trust engagements facilitated through phone calls. Notably, our customers have highlighted instances involving field agents in insurance or wealth advisors in asset management, who exclusively rely on voice recognition during client interactions conducted over the phone. The concerns surrounding deepfakes also surpass customer interactions, with numerous companies expressing apprehension about the potential impersonation of their executives in internal communications, raising the specter of corporate fraud.

4. Create room for deepfake detection in your operating plan

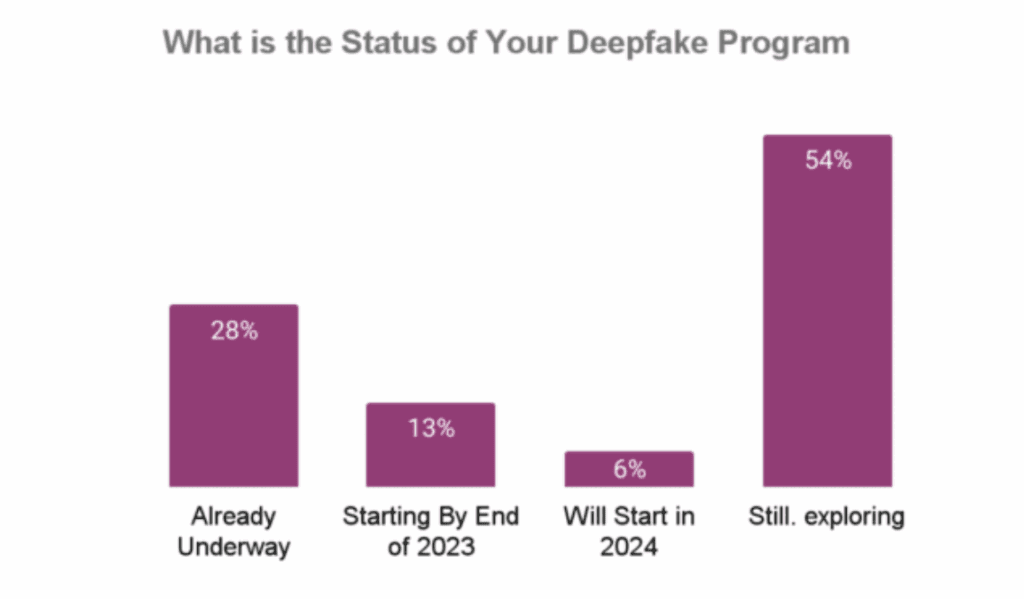

Deepfake detection needs to be on companies’ roadmaps now. 28% of respondents are actively assessing deepfake vulnerabilities and exploring solutions. Customers highlighted lack of expertise in the industry as a hurdle in their ability to accelerate their explorations. Pindrop is stepping up to meet this need. Pindrop recently formed a customer advisory council to help create and share best practices among its customers.

Source: Pindrop Client Forum Exchange, June 2023 survey of 100 executives across 40 US financial institutions, health care providers and retailers

Several Pindrop customers are running tests to understand their current state of deepfake preparedness. Pindrop is leveraging its expertise to advise those organizations to harden their defenses. The upcoming deepfake detection module from Pindrop that is fully integrated in both Passport and Protect products will significantly accelerate customers’ ability to run pilots and operationalize deepfake detection as part of their existing policy frameworks.

Interest in deepfake detection amongst enterprises is high as more instances of public and financial deepfake attacks have surfaced. While deepfake detection was not on the original roadmaps of many companies, the elevated risk of deepfakes has caused executives to pivot to enhancing their call center fraud protection frameworks as well as their internal security posture with deepfake detection technology. Pindrop is leading the way with the announced launch of a fully integrated deepfake detection module that serves both the fraud detection and authentication needs of enterprises. Contact an expert to learn more.