Insurance

Insurance - Fraud Detection Solutions

Elevate security across the insurance sector with advanced fraud detection solutions, ensuring a more resilient and efficient industry.

Protecting The Insurance Industry

Safeguard Brand & Reputation Risk

Reduce Fraudulent Claims & Scams

Provide Outstanding Policyholder Experience

Lower Operational Costs

How Pindrop® Solutions Help Protect Insurance

Pindrop® solutions can help insurers reduce reputational risk, identify false claims, improve policyholder experience, and improve operational efficiency in the contact center.

Anti-Fraud

- Fraudulent claims

- Policy cashout and refund scams

- Fraudulent Special Investigative Unit (SIU) interviewing

Authentication

Give customers faster, better service when verification questions are no longer needed. Pindrop solutions help you passively authenticate your customers with unique multi-factor credentials based on device, voice, and behavior. Advanced authentication helps insurers:

- Reduce call resolution time for policyholders

- Improve consumer self-service capabilities in the IVR

- Improve policyholder experience

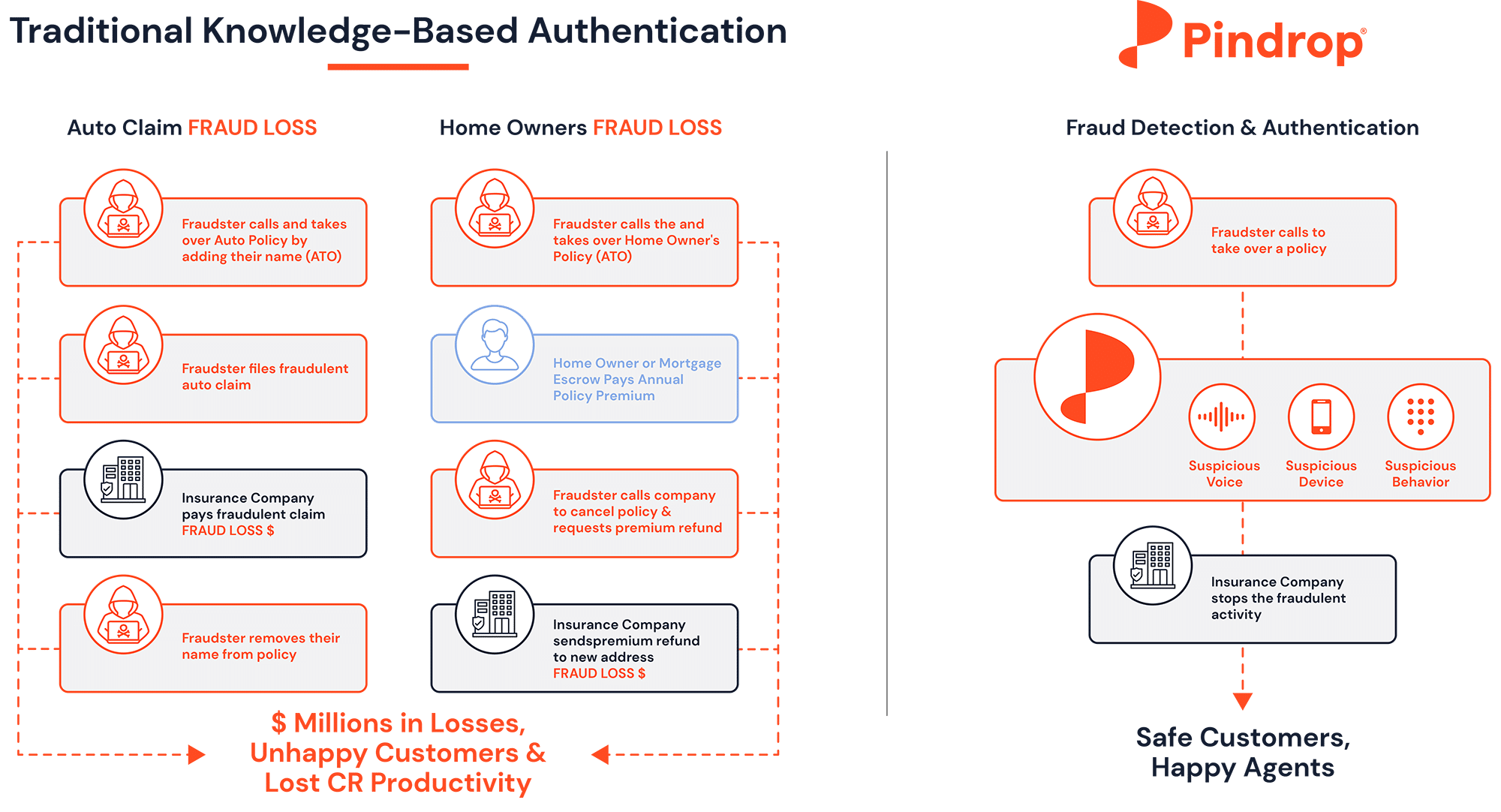

The Struggle To Identify Callers & Build Trust

While many insurance companies have strengthened their online and physical security, insurance call centers remain a weak link. Because customers don’t call frequently, fraudsters can access accounts for months or years without customers knowing.

Whether these sophisticated criminals liquidate or take over an account, file false claims, or complete fraudulent policy surrenders, they’re putting customers’ legacies and financial futures at risk. They also threaten to permanently damage the trust that is essential to maintaining a potentially lifelong relationship with policyholders.

Resources

Interested in learning more about Pindrop’s solutions?

Case Study

Case Study

Case Study

Partner & Customers

Elevate Insurance Security with Pindrop

Sources:

2. FBI: https://content.naic.org/cipr-topics/insurance-fraud