Pindrop Labs discovered drastic increases in call center fraud from 2015 to 2016 after analyzing more than half a billion calls. Last week, Dr. David Dewey, Pindrop’s Director of Research, hosted an online discussion on the findings from the 2017 Call Center Fraud Report, analyzing the latest data points and evaluating the reasons for the surge in call center fraud.

Top 5 Takeaways

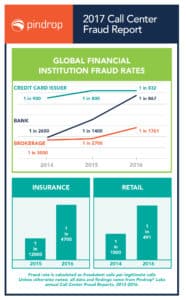

1. In 2015, one in every 2,000 calls were fraudulent. In 2016, call centers faced a rise in fraudulent calls, experiencing a 113% increase with one in every 937 calls being fraudulent.

2. The global fraud trend is driven by four main factors: the growing sophistication of fraudsters, data breaches, weak security, and the rollout of chip (EMV) cards.

- Growing Sophistication. Fraudsters are constantly innovating and employing different tactics to gain access to accounts and ultimately commit fraud. With Caller ID spoofing apps, burner phones, and other devices, fraudsters can manipulate call characteristics to get past traditional security measures.

- Data Breaches. In the case of data breaches, intelligence is often leaked directly to or purchased by fraudsters, which often leads to account takeover. Before this happens, however, fraudsters typically make multiple interactions with the call center. During these interactions, the criminal gains more and more information about the account or policy holder. Dewey states, “Fraudsters often know more about the victim than the victim knows about themselves.”

- Weak Security. Traditional security systems, such as knowledge-based authentication questions (KBAs), or systems relying on only one method of security often prove to be weak. If

security systems are not readily updated, fraudsters become familiar with them and can hack into them with more ease. Additionally, call center representatives are typically more concerned with customer experience than deterring fraud, which also influences the levels of security put in place. These call center representatives are also known to fall victim to the social engineering tactics that these fraudsters employ

- EMV Technology. The rollout of EMV chip cards has made it far more difficult to commit card-present fraud, which has resulted in an increase in card-not-present fraud, leading to an increase in the amount of fraudsters perpetrating over the phone.

3. Fraudsters have moved away from landlines, focusing more on mobile and voice over IP (VoIP) lines. In 2014, only 21% of fraudsters made their calls over mobile devices; however, today, mobile devices are used 43% of the time. This growth can likely be attributed to easy access to burner phones and available spoofing applications.

4. Fraud rates vary extensively across industries, each dependent on different factors. Some of the most alarming statistics include a 61% increase in call center fraud for banks and brokerages and a 55% increase for device insurance. The retail industry was also highly affected, with 1 in every 491 calls found to be fraudulent.

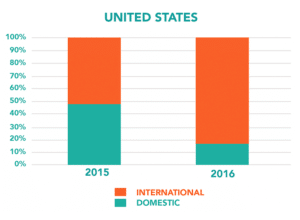

5. The escalation in international fraud in the U.S. can most likely be attributed to the rise of mobile devices and the utilization of VoIP. The U.K. is experiencing more domestic fraud, which is most likely due to EMV cards and differences in chargeback policies.

Thank you for listening!

Catch the on-demand session.