Passive Authentication for Voice Security

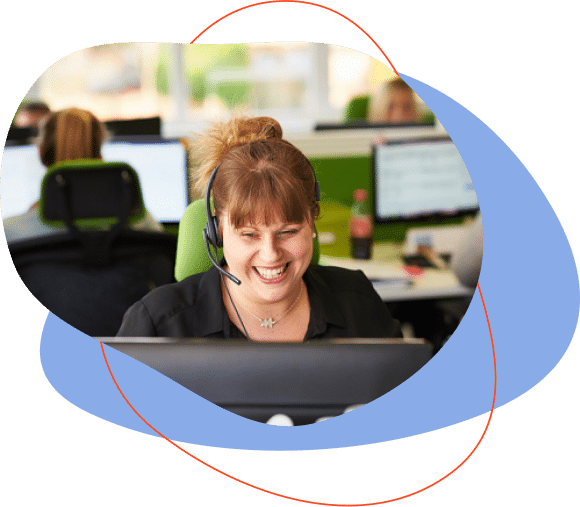

Optimize voice security with our advanced neural network-based biometric recognition engine, ensuring seamless passive authentication and efficient fraud detection.

Pindrop helped them reduce fraud, improve their customer experience, and reduce operational costs.

When it comes to deploying your cloud-based contact center, there is rarely a “one-size-fits-all” easy button. Pindrop has a robust network of carriers, platforms, contact centers, and system integrators to give you the flexibility you need.

Pindrop’s voice technology is innovating customer experiences by combining the ease and security of voice authentication to make accessing your digital world more human. Pindrop uses passive technology to reduce average handle time, increase IVR containment, and improve the customer experience in your contact center.

Securely authenticate callers–without their voice–by combining call metadata, device and behavior analysis, and risk intelligence.

Simplify authentication with machine learning that instantly validates the source of a phone number and reliably detects call spoofing.

Replace security questions and passcodes with multi-factor authentication that secures valid customer interactions in your contact center, with no effort from them.

Add a layer of security to any voice interaction by identifying unique voice profiles—without ever enrolling an unknown caller