Case study

Fortune 500 Insurer Detects 97% of Deepfakes and Stops Synthetic Voice Attacks with Pindrop® Pulse

Pindrop® Pulse helped a large U.S. insurer detect deepfakes and synthetic voice activity in their contact center to stay ahead of the AI threat. As one of the largest providers of life insurance products in the U.S., its priority was to enhance security and avoid financial losses. In combination with Pindrop® Passport, Pulse provided an additional layer of security and further increased confidence in the voice channel.

The insurer is a Fortune 500 company that offers a wide range of products and services, including insurance, retirement, and investing. The leadership team was concerned about the rise of deepfakes and wanted to proactively protect their customers and their company.

Our Pindrop® Pulse solution detected deepfakes in the insurer’s contact centers with a 97% accuracy rate,1 exceeding expectations and providing a strong framework to help protect its customers. Pindrop Pulse solution, in combination with our Pindrop Passport multifactor authentication solution, gave the insurer confidence that its voice channel is well protected.

About the insurer

A leading U.S.-based insurer with over $1 trillion of life protection in force, this company provides a broad range of products, including life insurance, income protection, retirement products, annuities, and investment solutions. With protection at the core of what they do, the insurer recognized that new AI technologies could pose a significant challenge from fraudsters targeting accounts in the voice channel. As a long-time customer of the Pindrop® platform, the insurer sought Pindrop’s help in making its voice channel even more secure.

Challenges

Leaders at the insurance company were concerned about the practical implications of deepfakes on organizational security after learning of a high-profile deepfake attack in 2024. In May of that year, engineering firm Arup publicly acknowledged that an employee at their Hong Kong office had fallen victim to a deepfake attack and paid out $25 million to fraudsters. The employee, a finance worker, was duped into attending a video call with people he believed were the Chief Financial Officer and other members of staff, but all of whom turned out to be deepfake re-creations. The employee initially had doubts about the request, but was convinced after the video call because deepfakes looked and sounded just like the colleagues he recognized.

This incident, along with the general trend of AI sophistication, spurred the insurer’s leadership to further assess this potential threat with an enterprise-wide deepfake risk assessment and mitigation strategy. One recommendation from that exercise was to strengthen deepfake detection capabilities for both the voice channel and video collaboration tools like Zoom®.

The insurer already trusted Pindrop® Solutions with its contact center fraud detection and authentication needs, so they reached out to the Pindrop customer success team for help with deepfake detection as well.

Goals

The insurer had three goals as they sought a new solution:

Strengthen the organization’s capabilities to detect deepfakes

Detect deepfakes with a high level of accuracy

Integrate deepfake detection tools with the organization’s existing authentication solutions

Before Pindrop® Solutions

“Don’t wait for the bad thing to happen. Get in front of it before it happens.”

– Head of Fraud Operations

The insurer had been using Pindrop® Protect to detect fraud attempts and Pindrop® Passport to authenticate customers in the contact center. To strengthen its contact center authentication strategy, the insurer realized it needed to expand the ecosystem to include an AI-based deepfake detection solution like Pindrop® Pulse.

The insurer had not yet experienced a deepfake event in the contact center, but was monitoring the significant advancements in the AI landscape and fraudsters’ ability to easily create realistic deepfakes. In response, the insurer decided to proactively prepare for the inevitability of deepfake attacks.

Larger market trends support the insurer’s thesis of the evolving AI threat. AI models such as text-to-speech (TTS) systems, the fundamental building blocks of deepfakes, have exploded in both quantity and sophistication. The number of TTS models listed on Huggingface grew from 300 in 2023 to 3,300 today – a 11x (1,100%) increase in just two years. Massive technological advancements like Nvidia’s Riva Magpie zero-shot voice cloning allow synthetic speech tools to generate a desired voice using just a few seconds of reference audio, making it easier for impersonators and scammers to perpetrate fraud at a large scale.

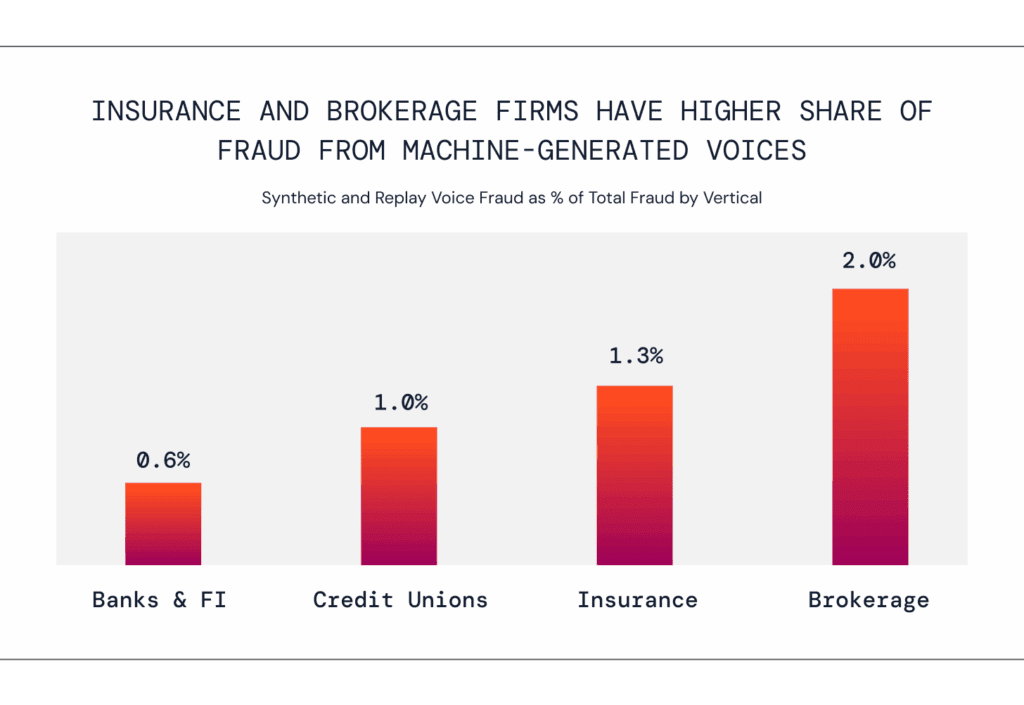

Pindrop data from the 2025 Voice Intelligence and Security Report showed that deepfake fraud attacks on contact centers have grown from one attack every two days in 2023 to seven attacks per day in 2024 – a massive jump of 1,337%. Pindrop research also revealed that synthetic voice fraud in banks and insurance companies spiked by 149% and 475%, respectively, during 2024. Insurance firms are also experiencing a larger share of synthetic and voice fraud attacks than some of their financial peers.

According to Pindrop internal data, insurance fraud in 2024 rose 19% year-over-year, with a fraud rate of 1 in every 4,359 calls (0.02%) across life, health, and property casualty sectors. While this rate is lower than banking’s 0.17% fraud rate, the average fraud exposure in insurance is 20 times higher, making each incident significantly more costly.

The insurer recognized the risk posed by deepfakes’ growing sophistication and decided to fight fraudsters with better tools: AI-based deepfake detection.

Why Pindrop® Solutions

“We’ve done business with Pindrop for the last 10 years, and we trust Pindrop. When we give feedback, they take it in and incorporate it into developing those features.”

– Senior Director, Fraud Operations

The insurer has leveraged the Pindrop® Protect fraud detection solution in its contact center for nearly a decade and the Pindrop® Passport solution for caller authentication for more than five years. The Pindrop platform has successfully helped the insurer to detect fraud (73% fraud detection rate) and authenticate genuine callers (90% profile match authentication rate) in the contact center.2 With deepfakes on the rise, the insurer turned to Pindrop for help.

Although deepfakes have recently gained mainstream prominence, Pindrop has worked on deepfake detection technology for more than a decade. Pindrop published its first deepfake research paper in 20153 and has been an industry-leader with high performances in the ASVSpoof benchmark challenge since 2017. Pindrop® Pulse now has 75 patents in audio and video deepfake detection and is trained on +570 deepfake tools and a dataset of 30M utterances. Few competitive solutions can match the depth and scale of Pindrop® Pulse.

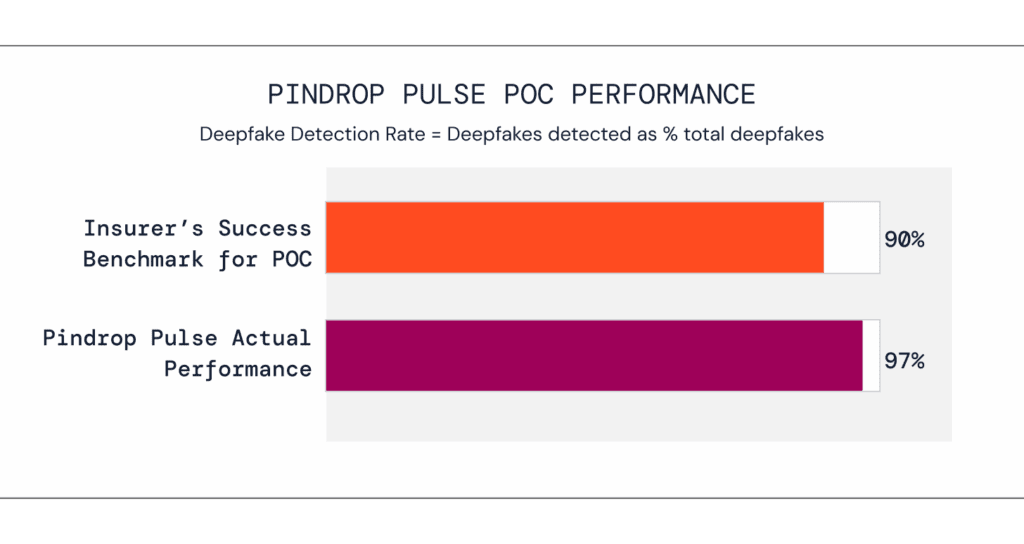

The insurer tested Pulse in its contact center and found that the solution exceeded its expectations. Pulse detected 97% of deepfakes, comfortably beating the insurer’s benchmark.

“When we did the POC (Proof of Concept) with Pindrop, we were pleased with the results. So, we did not feel the need to look externally.”

– Head of Fraud Operations

The insurer specifically wanted a deeper understanding of deepfakes in their environment. It was important to break down their nature, purpose, and technology, such as whether the deepfake involved voice modulation, a synthetic voice, or a recorded voice. When the insurer scanned the deepfake detection technology provider space, they found that several providers did not have the technological maturity and depth to handle that level of distinction with accuracy, but Pindrop Pulse was able to.

“There are some unique features that we wanted to incorporate (for example, the ability to differentiate modulated vs synthetic voices). We were not really able to have those conversations with competitors. Everybody says they have liveness detection and can give you a score, but they couldn’t really go into the details like Pindrop was able to.”

– Senior Director, Fraud Operations

Maintaining a high-quality customer experience in the contact center is crucial. Any false positive (the error when the solution wrongly identifies a human voice as a deepfake) requires a higher level of authentication, adding friction for both the customer and the contact center representative, and creating more work for the fraud team. Our solution’s low false positive rate gave the insurer confidence that their customers would not be negatively impacted, and the overall burden on the organization would be reduced.

“We have precious, limited resources. So, we have to make sure our team spends time on the most valuable risk signals. We want to minimize spending time on non-value-added activities such as investigating false positives.”

– Head of Fraud Operations

Why did the insurer choose Pindrop® Pulse?

Decade-long trust in the existing, high-performing solutions from Pindrop

Proof of Concept (POC) performance that exceeded expectations

The depth and robustness of the solution

The ability to reduce workload with lower false positives

History of incorporating the insurer’s feedback into new features and solutions

Pindrop® Pulse delivers ROI

The insurer deployed the Pindrop Pulse solution in its contact center at the end of 2024 and immediately saw a significant impact.

Detected synthetic voices

Shortly after deployment, Pulse detected a synthetic voice in the insurer’s contact center identifying itself as “Jamie.” Unlike a typical account takeover attempt, Jamie asked to speak with a specific insurance agent. After learning that the insurance agent no longer worked there, Jamie pressed for contact information and ultimately settled for the phone number of the agency the agent had left.

The call lasted for over 4 minutes. Jamie sounded very human-like, with changes in tone, pitch, and inflection in response to the agent’s questions. The bot had a full-fledged conversation with the agent with very few unnatural pauses or delays and quickly responded with pleasantries (“Thank you for that information”). It also engaged in small talk (“How is your day going?”).

The Pindrop® Pulse system detected the voice as synthetic, but the voice could pass as real to the human ear. When the call was flagged, the insurer’s fraud team evaluated it and deduced that it was possibly a fraudster testing if a synthetic voice bot could have a long, unsupervised conversation with a real human without raising suspicions, or reconnaissance to understand the insurer’s call center procedures.

“It was pretty impressive to hear just how real the voice sounded…like a very legitimate female voice looking for a specific insurance agent. Prior to [Pindrop] Pulse, we would not have picked up on something like that. The customer service rep did not pick up on it.”

– Senior Director, Fraud Operations

From this case, it’s evident that fraudsters are no longer using the old method of typing responses in a TTS system, but have now created fully autonomous and human-sounding bots that can hold an extended conversation. Once sufficiently advanced, hundreds of these bots can be constructed to simultaneously attack multiple organizations.

Reduced fraudster enrollments and authentication attempts

Within months of being deployed (January-March 2025), Pindrop Pulse detected and helped block 68 enrollment attempts involving synthetic voices. The insurer incorporated the scores and feedback provided by Pulse into its caller enrollment and authentication policies. Now, when Pulse detects a synthetic or non-live voice, the insurer does not allow the caller to enroll in their authentication solution, reducing the likelihood of a fraudster enrolling as a genuine customer.

During the same period, Pindrop Pulse also detected and helped prevent 141 authentication attempts that involved the use of synthetic voices, reducing the risk of fraudsters successfully authenticating with a synthetic voice to take over a customer account.

Helped protect customers

“Good security is good customer service.”

A big advantage for the insurer is that they were already using Pindrop Passport multifactor authentication to verify callers. Pindrop Pulse is integrated with Passport and provides a more seamless way to incorporate deepfake scores and feedback into the authentication process.

If a synthetic voice was suspected prior to Pulse, the insurer would use a step-up authentication process to verify the caller. Now, a synthetic voice automatically triggers a “do-not-authenticate” policy, preventing step-up authentication. Instead, the insurer routes these calls to the fraud team, increasing the likelihood of stopping fraud attempts.

“Pulse, in addition to Passport, helped us take more of a risk-based approach when authenticating our customers. When a synthetic voice is detected, we add some friction to the call, but that is good friction. It’s a friction that we want to add and have our [fraud] team look into it.”

– Senior Director, Fraud Operations

With Pindrop Pulse in place, the insurer is confident that it is better equipped to protect its customer accounts from fraud. For the insurer, this additional protection adds another layer of value to the customer experience.

“Good security is good customer service. Maybe our customers don’t know they’re getting good service, because they don’t know if a fraudster is calling in on their account and trying to take it over. But by having capabilities like these [Pindrop Pulse] in place, we are protecting those customer accounts. So, by default, that is a good customer experience.”

– Head of Fraud Operations

What’s next for the insurer and Pindrop?

As attackers evolve, their methods will target other places where organizations are vulnerable, such as in executive impersonations, HR interviews, hiring, employee onboarding, and wealth management. To further enhance its security, the insurer wants to adopt a cutting-edge solution like Pindrop Pulse for meetings to help protect against deepfake attacks in video calls.

“We feel very strongly that the combination of the products we use from Pindrop and our other capabilities gives us a relatively strong control environment that we feel good about.”

– Head of Fraud Operations

About Pindrop® Pulse

Pindrop® Pulse is an industry-leading audio deepfake detection solution that, when combined with the Pindrop multi-factor platform, can detect up to 99% of synthetic voice fraud in the contact center. Pulse technology seamlessly integrates with our fraud detection and authentication platforms and is meticulously designed for real-time deepfake detection across all stages of a phone call. The award-winning Pindrop Pulse technology is built with proprietary datasets and 300+ Pindrop patents, and is backed by an exclusive Pindrop Pulse Deepfake Warranty (terms and conditions apply).

Pindrop® Pulse for meetings uses industry-leading deepfake detection technology that leverages multi-modal analysis to detect synthetic audio and video threats. Seamlessly integrating with major meeting platforms like Zoom, Webex, Google Meet, and Teams, Pindrop® Pulse for meetings delivers continuous, real-time analysis for your most critical business interactions.

1 Pindrop Pulse deepfake detection rate in 2 month POC conducted by the insurer from Oct-Dec 2024

2 Pindrop analysis of Insurer call center call volumes, fraud detection rate for 2024 full year and authentication rate for first quarter 2025

3 Pindrop paper published at IEEE International Conference on Biometrics: Theory, Applications, and Systems (BTAS), 2015