Case study

One Year Later: Michigan State University Federal Credit Union Minimizes Fraud Exposure by Millions

Key results

58 seconds faster authentication

$2.57M reduction in fraud exposure

10% increase in member satisfaction

Michigan State University Federal Credit Union (MSUFCU) is a member-owned and governed financial cooperative with $8.3B in assets, 360k members, and 1,300 employees across 36 locations. As a forward-thinking and member-first organization, MSUFCU transformed its digital experience infrastructure in Aug 2024—with the combined power of Pindrop® Solutions and Five9.

MSUFCU launched the member experience initiative with three clear goals:

Improve member experience via frictionless, real-time authentication

Reduce voice and cross-channel fraud without adding friction to member experience or burdening employees with additional work

Reduce costs by increasing operational efficiencies

The credit union chose and implemented both Pindrop® Protect and Pindrop® Passport to drive their initiative forward. MSUFCU selected Pindrop for its innovative technology and industry leadership in deepfake detection solutions, as well as its expertise in passive, frictionless authentication technology and strong operational, project management.

Authentication time was cut in half in the first 3 months

Within the first 90 days of implementation, Protect and Passport delivered immediate return on investment. By reducing member authentication time by 45 seconds and improving customer satisfaction scores from 4.47 to 4.56, Pindrop solutions put MSUFCU on track to reduce operational costs by $561,600 on an annualized basis.

“An agent said on the first day that the calls felt so much better, and [Pindrop] helped them to offer more products and services to members, which is a huge thing, both for what our members need and for the organization.”

—Colleen Cole, VP of Member Service Center, MSUFCU

Year one results: Cost savings, higher customer satisfaction, and reduced fraud exposure

While early results were strong, the full year of results surpassed expectations.

Cut average handle time (AHT) by 58 seconds

Before partnering with Pindrop, the credit union had observed an increase in its average call duration from 6 minutes to 8.5 minutes over a four-year period, with 90 seconds typically spent on member authentication.

This longer call time was impacting both efficiency and member satisfaction. After implementing Pindrop authentication solutions, the credit union saw rapid results: within just a few months, average call duration dropped to 7 minutes and 43 seconds—saving 45 seconds per call by streamlining the authentication process.

The result: faster service, improved member experience, and greater operational efficiency.

Over the next 12 months, the credit union achieved even greater efficiency, reducing average call duration to just 6 minutes and 45 seconds.

Powered by Pindrop® Passport, a multifactor authentication solution, the team eliminated 58 seconds of authentication time per call, driving $723,840 in annual operating savings—exceeding the initial 2025 forecast by $162,000.

Since September 2024, Passport has authenticated 244,000 calls using Profile Match Authentication, which authenticates members through their enrolled voice and device profiles. An additional 273,000 low-risk calls were authenticated using Low-Risk Authentication, powered by passive caller ID risk analysis.

Within just one month of deployment, authentication rates jumped from 51% to 63%. This rapid improvement was driven by the powerful combination of passive caller ID risk analysis and voice profile matching—enabling faster, more secure authentication while reducing friction, enhancing member trust, and lowering operational costs.

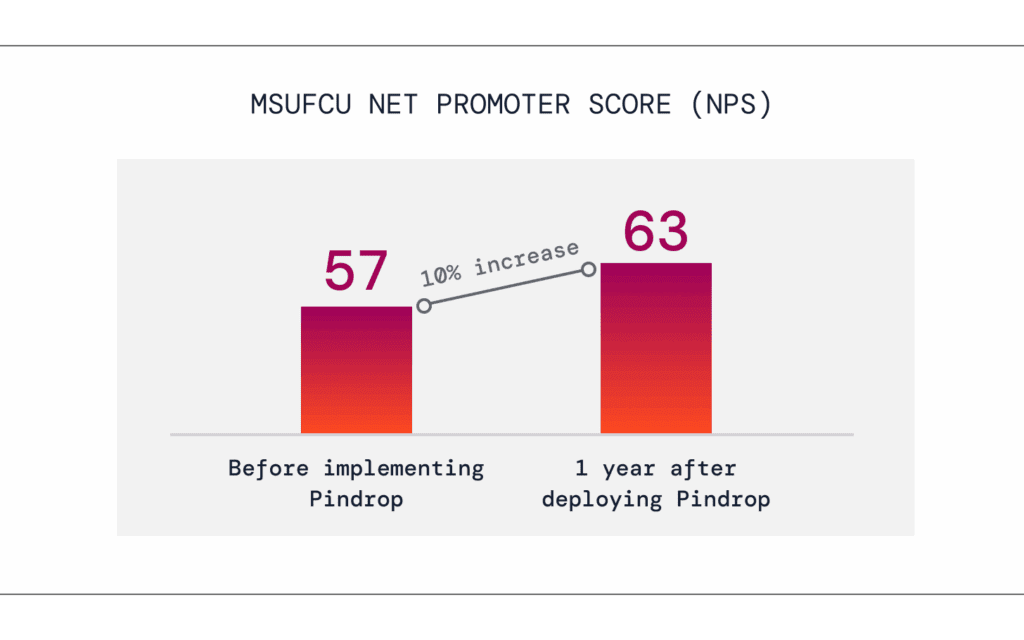

10% increase in member satisfaction

Before implementing Pindrop solutions, MSUFCU already maintained an impressive Net Promoter Score (NPS) of 57, reflecting strong member satisfaction and loyalty.

Just one year after deploying the Pindrop platform, the NPS climbed to 63—a 10% increase. According to Colleen Cole, VP of the Member Service Center, this improvement is directly attributed to Pindrop, as the uplift in member satisfaction was observed immediately after implementation.

This measurable boost highlights how Pindrop not only enhances operational efficiency and security but also delivers a meaningful impact on member experience and loyalty.

Happier employees

With Pindrop® Passport, MSUFCU streamlined authentication, boosting both member and agent satisfaction.

Agents report smoother, faster calls and a better work experience.

“Today is just one of those days to reflect on how much [Pindrop] voice analysis makes our lives so much easier! Grateful that we are able to have a resource like that!”

—MSUFCU Employee

The results speak for themselves: MSUFCU’s call center employees rated their tools and resources 4.41 out of 5, underscoring the real value Pindrop brings to their daily work.

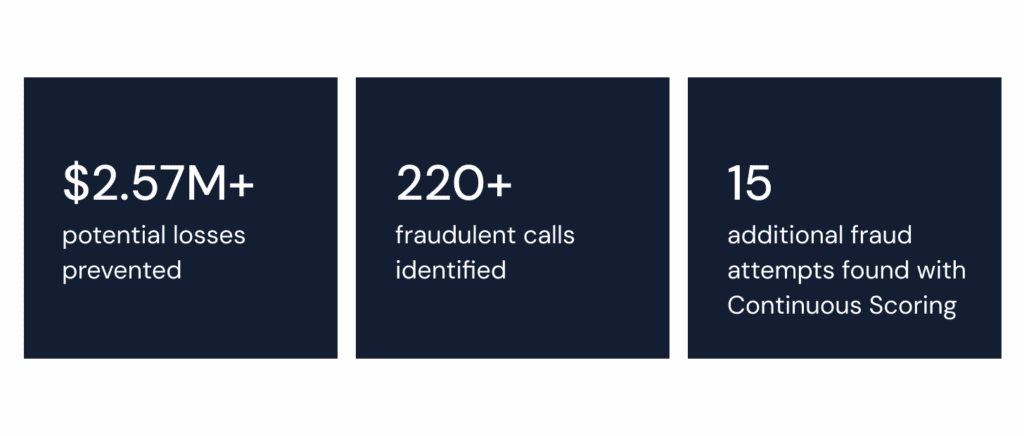

Massive reduction in fraud exposure

Recognizing the rising risks of contact center fraud, Jamie Smathers, the VP of Fraud Prevention and BSA, sought next-generation technology to strengthen the organization’s security posture.

Her team aimed to stop account takeovers, detect reconnaissance attempts, and stay ahead of emerging threats, including deepfakes and synthetic voices.

Pindrop® Protect helped MSUFCU prevent fraud before it could impact members—stopping over $2.57 million in potential losses and identifying more than 220 fraudulent calls.

With Continuous Scoring, Pindrop added another layer of protection, uncovering 15 additional fraud attempts using advanced “look-back” analysis. This real-time intelligence continuously learns from confirmed fraud cases, applying new insights to both IVR and agent interactions. By detecting hidden reconnaissance activity early, the credit union closed security gaps and strengthened its defenses against future attacks.

Using Pindrop® Protect, the fraud investigation team analyzed audio from multiple calls simultaneously, quickly identifying when the same fraudster targeted several accounts. This powerful capability exposed numerous account takeover attempts, identity theft attempts, and cases of first-party and friendly fraud, helping the credit union stop attacks before losses occurred.

Security for emerging deepfake threats

Deepfakes are an emerging threat to contact centers—and Pindrop data shows that 1 in every 106 calls is synthetic. For the credit union’s leadership and security teams, detecting these AI-generated voices was a top priority.

With Pindrop® technology, the organization identified deepfake and manipulated voices, including those altered to disguise identity, often linked to account takeover attempts. These insights empowered contact center agents to catch the new, sophisticated threat.

With Pindrop® technology, the organization identified deepfake and manipulated voices, including those altered to disguise identity, often linked to account takeover attempts. These insights empowered contact center agents to catch the new, sophisticated threat.

1 in every 106 calls is synthetic

According to Pindrop data

About the Pindrop and Five9 partnership

Since 2021, Pindrop and Five9 have partnered to deliver a best-in-class, pre-built integration that provides customers with passive authentication, fraud detection, and synthetic voice detection. Pindrop, recognized as Five9’s ISV solution of the year, continues to support a growing number of shared customers with Five9.

For MSUFCU, Pindrop and Five9 worked side by side—from design through deployment—and remain active partners in ongoing monitoring and optimization. Pindrop® solutions were seamlessly integrated into the Five9 agent desktop, creating a custom authentication gadget that displays member verification scores directly within the agent workflow.

The results speak for themselves: MSUFCU improved member experience, reduced fraud, and lowered costs in the first year. As the credit union expands passive multifactor authentication and advanced fraud detection, these gains are set to accelerate even further.